georgia estate tax rate 2020

For married taxpayers living and working in the state of Georgia. The Estate Tax is a tax on your right to transfer property at your death.

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

County Property Tax Facts.

. Georgia estate tax rate 2020. The state of Georgia requires you to pay taxes if you are a resident. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

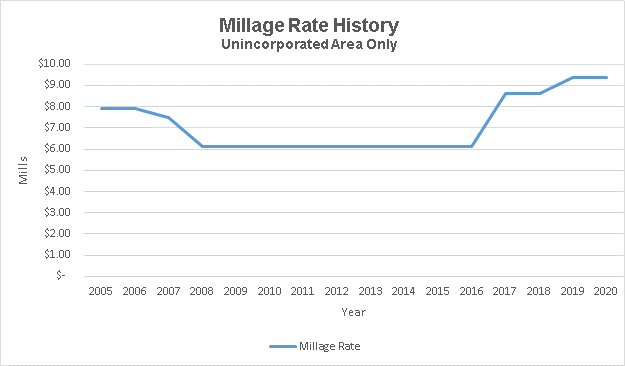

Property Tax Returns and Payment. Georgia Income Tax Tables. Information about Property Taxes Millage Rates and Car Tags.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Tax rate of 1 on the first 1000 of taxable income. Federal estate tax rates for 2022.

Pay Property Taxes Property taxes are paid annually in the county where the property is located. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Property Taxes in Georgia.

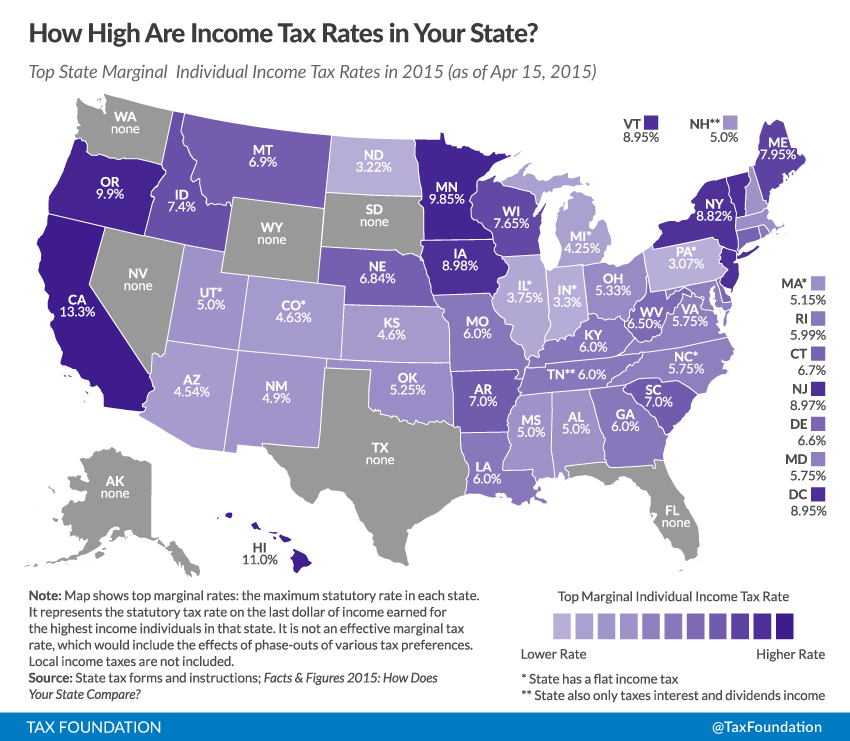

Historical Tax Tables may be found within the Individual Income Tax Booklets. Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31. The highest marginal tax rate in the state at 575.

To successfully complete the form you must download and use. They are very different organizations. In Gwinnett County these normally include county county bond the detention center.

Georgia law is similar to federal law. Property Tax Homestead Exemptions. 083 of home value.

Tax amount varies by county. Information about and links to both the Tax Commissioner and Tax Assessors Office. The Georgia County Ad.

48-12-1 was added to read as follows. Property is taxed according to millage rates assessed by different government entities. 2020 Tax Tables 16693 KB.

Tax rate of 575 on taxable income over 7000. Georgia Governor Brian Kemp recently. The above income tax rates are for the 2021 tax year.

While the state sets a minimal property tax rate each county and municipality sets its own rate. For a nationwide comparison of each states highest and lowest taxed counties see median property. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. 2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier.

Georgia Department of Revenue.

Tax Assessors Harris County Georgia

Free Georgia Bill Of Sale Forms 4 Pdf Eforms

Property Taxes Laurens County Ga

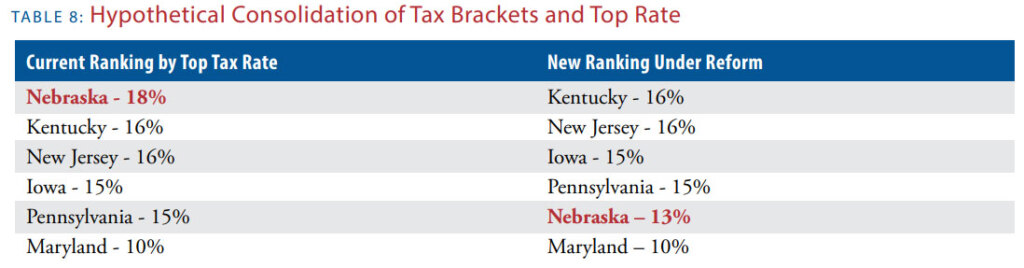

Death And Taxes Nebraska S Inheritance Tax

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

State Individual Income Tax Rates And Brackets Tax Foundation

Estate Tax Current Law 2026 Biden Tax Proposal

How Many People Pay The Estate Tax Tax Policy Center

Estate Taxes Are A Threat To Family Farms

Opinion Favorable Federal Gift And Estate Tax Rates Probably Won T Last Forever Here S What To Do To Prepare Marketwatch

Dc Lowers Estate Tax Exemption To 4 Million Royal Law Firm Pllc

Where S My Refund Georgia H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

Does Georgia Have Inheritance Tax

Estate Tax In The United States Wikipedia

Dekalb County Ga Property Tax Calculator Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger